Do you want to stay up to date with the latest updates and analysis of the Adani Wilmar share price? Our goal is to answer all your questions in this piece.

Adani Wilmar Limited is a renowned FMCG food company that provides various kitchen commodities in India. The company produces, refines, and sells a range of edible oils, including soybean, palm, sunflower, rice bran, mustard, groundnut, cottonseed, and blended oil. Adani Wilmar also offers specialty fats, such as industrial margarine, bakery shortenings, and vanaspati for baked products, and lauric fats for ice cream and confectionery.

The company has a diversified product portfolio that includes oleochemicals, wheat flour, rice, pulses, sugar, besan, poha, rawa, suji, soya chunks, soya flour, soya grits, soya flakes, soya bari, and ready-to-cook khichdi; soaps, handwash, and sanitizers. Adani Wilmar exports its products to various countries, including the Middle East, Southeast Asia, Africa, the United States, and Canada.

Adani Wilmar Share Price Today

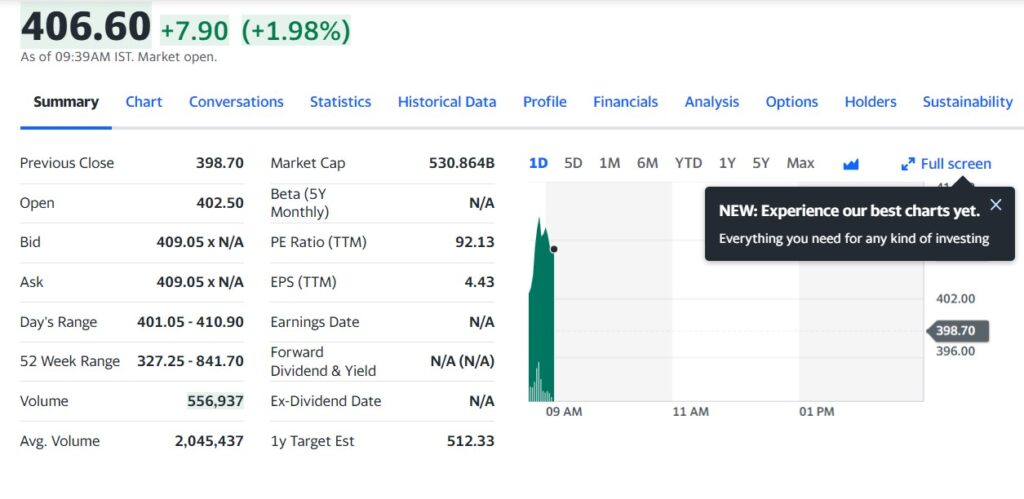

Adani Wilmar Limited (AWL.NS) share price:

| Information | Value |

|---|---|

| Previous Close | 398.70 INR |

| Open | 402.50 INR |

| Bid | 408.30 INR x N/A |

| Ask | 408.75 INR x N/A |

| Day’s Range | 401.05 – 410.90 INR |

| 52 Week Range | 327.25 – 841.70 INR |

| Volume | 525,535 |

| Avg. Volume | 2,045,437 |

| Market Cap | 531.58B INR |

| Beta (5Y Monthly) | N/A |

| PE Ratio (TTM) | 92.26 |

| EPS (TTM) | 4.43 |

| Earnings Date | N/A |

| Forward Dividend | N/A (N/A) |

| 1y Target Est | 512.33 INR |

|---|

Please note that the stock prices and data mentioned above are based on the information available at the moment and may change over time. Always verify the most recent data from reliable financial sources like Yahoo Finance before making any investment decisions.

Financial Sources you can check for the latest Adani Wilmar Share Price Today:

- Yahoo Finance: https://finance.yahoo.com/quote/AWL.NS/

- Google Finance: https://www.google.com/finance/quote/AWL:NSE

Adani Wilmar Share Price

As of July 14th, 2023, the Adani Wilmar Share Price is at ₹398.60, with a change of -0.038% from the previous close of ₹398.75. The day’s range was ₹397.50 – ₹403.95, and the year’s range was ₹327.25 – ₹841.70. The market capitalization of the company is 518.70B INR, and the P/E ratio is 88.99. The company currently does not offer a dividend yield. It is important to note that the share price and other financial data are based on the information available currently and may vary with real-time market conditions.

| Date | Share Price (INR) | Change (%) |

|---|---|---|

| Jul 14 | ₹398.60 | -0.038% |

| Prev close | ₹398.75 | |

| Day range | ₹397.50 – ₹403.95 | |

| Year range | ₹327.25 – ₹841.70 | |

| Market cap | 518.70B INR | |

| P/E ratio | 88.99 | |

| Dividend yield | – | |

| Primary exchange | NSE |

Factors Affecting Adani Wilmar Share Price

Several factors can influence the Adani Wilmar Share Price, including industry trends, competition, and government policies.

Industry Trends: The edible oil industry in India is highly competitive, with several players vying for market share. A few large players, including Adani Wilmar, Marico, and Godrej Industries dominate the industry. The industry is expected to grow at a steady pace, driven by rising demand for packaged food products, changing dietary patterns, and increasing health consciousness among consumers.

Competition: Adani Wilmar faces stiff competition from other players in the edible oil market, including established brands like Fortune, Saffola, and Dalda. The company has been able to maintain its market position by offering a wide range of products and investing in branding and marketing activities.

Government Policies: Government policies can also impact the Adani Wilmar Share Price. The Indian government has implemented several policies to support the edible oil industry, including increasing import duties on edible oils, providing subsidies to farmers, and promoting the use of indigenous oilseeds. These policies can impact the company’s profitability and market position.

Future Outlook for Adani Wilmar

Adani Wilmar is well-positioned to capitalize on the growing demand for packaged food products and the increasing health consciousness among consumers. The company has a strong brand, a diversified product portfolio, and a robust distribution network.

The company has also been investing in research and development to develop new products and improve its manufacturing processes. Adani Wilmar has been focusing on sustainability with initiatives like using renewable energy sources and reducing water consumption.

However, potential risks could also impact the Adani Wilmar Share Price. These include increasing competition, rising raw material costs, and changing consumer preferences.

Conclusion

Investors closely watch the Adani Wilmar Share Price, as Adani Wilmar Limited is a key player in the Indian edible oil market. The company has diversified product portfolio and robust distribution network puts it in a good position to capitalize on the growing demand for packaged food products. However, investors should closely monitor industry trends, competition, and government policies, as these factors can impact the Adani Wilmar Share Price. With its focus on research and development and sustainability, Adani Wilmar is well-positioned to navigate the challenges and opportunities in the market.

Read Next:

6 Best Yahoo Finance Alternative Sites for News/Updates on Finance